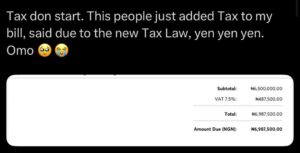

“Tax Don Start” — Influencer Cries Out After Paying ₦487,500 VAT on ₦6.5m Purchase

A Nigerian social media influencer identified as Raye has sparked widespread conversation online after revealing that she was charged ₦487,500 in Value Added Tax (VAT) on purchases totaling ₦6.5 million.

Her outcry comes days after the Federal Government’s revised tax framework took effect on January 1, 2026, introducing stricter VAT enforcement and tighter monitoring of high-value transactions. Eyes Of Lagos reports,

Taking to X (formerly Twitter), Raye shared a screenshot of the VAT charge attached to her purchase receipt, expressing shock and frustration over the amount deducted.

“Tax don start. These people just added tax to my bill; they said it’s due to the new tax law,” she wrote.

The post quickly gained traction, drawing reactions from Nigerians across different sectors.

While some social media users argued that stricter tax enforcement is necessary to improve government revenue and national development, others sympathised with influencers, entrepreneurs, and small business owners who are already grappling with rising operational costs.

Many pointed out that individuals earning through content creation, digital platforms, and online businesses may feel the impact of the new tax regime more intensely.

One user commented, “God abeg oo, this year go tough pass last year. How much tax be this?”

Another wrote, “Tax for a country that isn’t functioning well. It is well.

The Federal Government has said the new tax measures are designed to enhance transparency, reduce tax evasion, and expand the country’s revenue base, particularly in sectors with high cash flow and digital earnings.

However, as enforcement becomes stricter, more Nigerians are beginning to feel the immediate financial impact, fueling ongoing debates about taxation, accountability, and public service delivery.