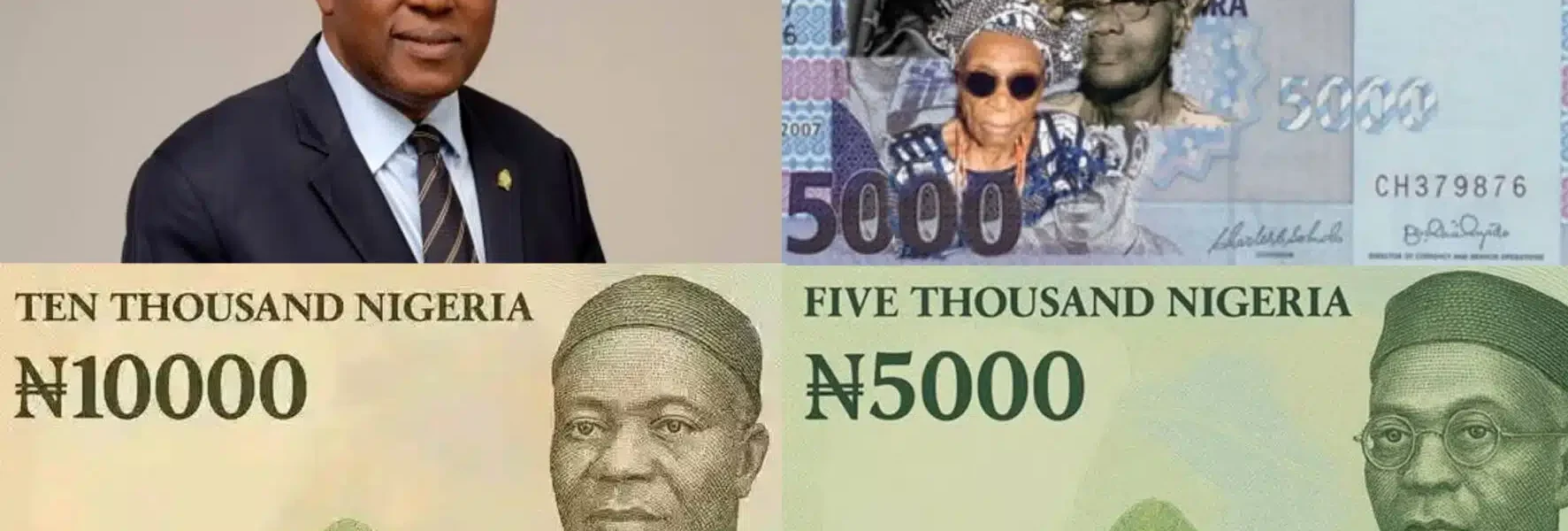

Quartus Economics Urges CBN to Introduce ₦10,000 and ₦20,000 Notes to Reflect Naira’s True Value

Economic research firm Quartus Economics has advised the Central Bank of Nigeria (CBN) to introduce higher-value currency denominations — specifically ₦10,000 and ₦20,000 notes — to make the naira more practical, portable, and reflective of current economic realities.

The recommendation was contained in a new policy report titled “Is Africa’s Eagle Stuck or Soaring Back to Life?” which analyzes Nigeria’s post-reform economy and the challenges facing the naira’s usability and credibility. Eyes Of Lagos reports,

The Naira’s Sharp Decline in Real Value

According to Quartus Economics, Nigeria’s highest denomination, the ₦1,000 note, has lost nearly all its real purchasing power since it was first introduced in 2005. At that time, ₦1,000 was worth about $7 at the official exchange rate, but today it is worth less than $0.60, highlighting a dramatic fall of more than 90% in real value.

The report noted that when the idea of a ₦5,000 note was proposed in 2012, it would have been equivalent in value to roughly ₦50,000 today, given the continued depreciation of the naira.

“A ₦5,000 note in 2012 is equivalent to ₦50,000 today, after a 94% loss in the naira’s real value,” the report stated.

Dispelling Myths About Inflation and New Notes

Contrary to public belief, the analysts argued that introducing higher-value notes does not automatically lead to inflation. Instead, they emphasized that inflation is primarily driven by cost-push and demand-pull factors — such as energy prices, supply chain costs, and monetary expansion — not the face value of currency denominations.

“Countries introduce higher-value notes to maintain portability after significant depreciation, not to trigger inflation,” the study clarified.

The firm cited examples from Indonesia, India, and Kenya, where larger notes were introduced without sparking runaway inflation, suggesting that Nigeria could follow similar models to modernize its currency system.

Cash Transactions Becoming Cumbersome

The report highlighted the growing inconvenience of everyday cash transactions across Nigeria, especially within the informal sector where digital payments are less accessible.

Traders, artisans, transport operators, and rural consumers now carry bundles of ₦500 and ₦1,000 notes for ordinary transactions — a situation Quartus Economics described as “economically inefficient and physically burdensome.”

“Outside the formal sector and the urban elite, the naira’s heavy weight is a drag on daily life and slows down growth,” the report added.

The cost of printing, transporting, and securing large volumes of low-value notes has also become an increasing financial burden for the CBN.

Modernising the Currency System

Quartus Economics argues that the introduction of ₦10,000 and ₦20,000 notes — or a full currency redenomination — would modernize Nigeria’s financial system, improve efficiency, and reduce operational costs for the apex bank.

“A higher denomination note is not about printing more money; it’s about adjusting the currency to reflect economic reality,” the report stated.

The analysts recommended that any reform should be accompanied by stronger digital payment infrastructure and financial literacy campaigns to encourage broader acceptance of electronic transactions alongside cash.

Economic Realities Justify New Denominations

The firm illustrated the naira’s loss of purchasing power with real-life examples, noting that basic goods and services have multiplied in price over the past two decades.

-

A kilogram of imported rice, which sold for ₦150 in 2005, now costs around ₦2,500.

-

Domestic flight tickets that cost ₦12,000 two decades ago are now as high as ₦150,000.

These indicators, the report argued, demonstrate how much the naira’s value has eroded and why higher-value notes are necessary to restore practicality in daily use.

“These indicators show how much the naira has lost its purchasing power, and a higher-value note is needed to make the naira portable again,” the report concluded.

Revisiting an Old Proposal

The idea of higher-denomination notes is not entirely new in Nigeria. In 2012, then-CBN Governor Sanusi Lamido Sanusi proposed a ₦5,000 note as part of a broader currency restructuring plan. However, the proposal was shelved after strong public opposition amid fears that it could fuel inflation and corruption.

Quartus Economics insists that those concerns were misplaced and that the current economic environment makes the introduction of higher notes not only logical but necessary.

“The argument against higher-value notes is outdated. Nigeria’s currency system must evolve to reflect today’s realities,” the report said.

Looking Ahead

As Nigeria continues to grapple with currency instability and inflation, the call from Quartus Economics adds to the ongoing debate about monetary reform and the sustainability of the naira.

Whether the Central Bank of Nigeria will consider the proposal remains to be seen, but the conversation around modernizing the currency has once again taken center stage — driven by data, economics, and the quest for a more efficient financial system.